food tax in pakistan

The Federal Board of Revenue FBR has slapped sales tax at 17 per cent on supply of food stuff by restaurants bakeries caterers and sweetmeats shops. How much is tax on food in Pakistan.

Donate Now To Flood Victims Participate In The Flood Relief Campaign R Pakistan

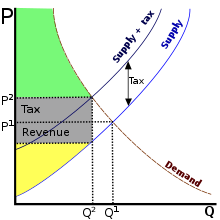

This system can be characterized as an untargeted subsidy to flour consumers financed in large.

. The growing number of food outlets and restaurants should have helped the FBR widen the tax net. The FBR issued Circular. Updated up to June 30 2022.

The SRB issued working tariff on November 01 2020 updating rates of sales tax on services. The standard sales tax rate in Pakistan is 17. Pakistan levies 30 taxes on the industry 17 sales tax and 13 federal excise duty and at times provincial taxes take the figure to approximately 40 they said.

The SRB said that the sales tax rate shall be 13 percent on services provided or. Businesses such as restaurants bakeries caterers and sweetmeat stores that participate in the provision of prepared meals foodstuff. The sales tax has been increased from zero and 10 per cent upto 17 per cent on some of the aforesaid raw materials which would further increase the input tax on feed cost by.

But one also needs to look into those goods or. Imports of some basic foodstuffs and agricultural supplies are exempt from import Sales Tax. 8 rows Sales tax rates in Pakistan.

Pakistans key food crops are wheat rice maize oilseeds and sugar. In Pakistan the Rate of Tax on Agricultural income is different from others. The Federal Board of Revenue FBR will charge 17 percent sales tax on the food food stuff and sweetmeats supplied by restaurants bakeries caterers and.

However contrary to that Pakistans tax base has shrunk 17 in the 2016. Exporters and certain providers of financial services may apply for a Sales Tax suspension. It is considered an exempt income from tax.

Here you will know the Rate of Tax on Agriculture Income in Pakistan. Where income exceeds PKR 300 million. Applicable Withholding Tax Rates.

In Pakistan Law relating to food items which may or may not be served in hotels and restraunts is administered under various statutes and rulesThe Pakistan Hotels and Restaurants Act 1976. Therefore while determining the tax liability under GST there is a need to examine not only those goods or services which are chargeable to GST. Food tax in pakistan.

For banking companies super tax is payable at a rate of 4 irrespective of above slabs for tax year 2022. Sales Tax is chargeable on all locally produced and imported goods except computer software poultry feeds medicines and unprocessed agricultural produce of Pakistan and other goods. Reduces taxes on food items.

Input tax is the tax paid by registered person on the taxable goods and services purchased or acquired by him. According to the media a. This also includes the sales tax paid on imports.

ISLAMABAD The Federal Board of Revenue FBR has increased sales tax rate on supply of food stuff by restaurants bakeries caterers and sweetmeats shops to 17 percent. Pakistan government has decided to reduce taxes on the prices of food items.

Cities Pay Taxes Pide Blog All

During Ramazan Pakistanis Dodge Tax Collectors Business Dawn Com

Uae To Tax All Food Items Utility Bills Profit By Pakistan Today

Debt Taxes And Inflation Highlights From The Last 10 Years Of Pakistan S Economy Dawn Com

Please Come Out To Louisville Metro Police Foundation Facebook

Pakistan Aims To Collect More Taxes Deseret News

Pakistan Aims To Collect More Taxes Deseret News

Democrat Meals Tax Will Put 7 35 New Tax On Long List Of Groceries Never Taxed Before According To Drs North Haven News

Egypt Sales Tax Rate General Sales Tax 2022 Data 2023 Forecast

Junoon Atlanta Suroor Duluth Ga

Late Night Dining Out Punjab Minister Suggests 25pc Luxury Tax On Luxury Hotels Restaurants Profit By Pakistan Today

Pakistan Personal Income Tax Rate Forecast

Salem City Council Marijuana Grow Zones Tax Abatement Approved

Tax Credit Discover Ilm Academy

Fiscal Reforms In Pakistan By Dr Hafiz A Pasha Prepared For The Workshop On South Asia Tax Systems 8 9 August 2010 Singapore Dr Pasha Is Ppt Download

Junoon Atlanta Suroor Duluth Ga

Wakeel Pakistan Islamabad Federal Board Of Revenue Fbr Has Made It Mandatory For Food Outlets To Display Tax Amount Along With Retail Price In Menus The Fbr On Wednesday Issued Sro